how are annuities taxed to beneficiaries

If theres a beneficiary they will inherit the annuity and usually have the option to take out the remaining sum and death benefits. Until the beneficiary withdraws the funds they do not.

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

How Annuities Are Taxed.

. Beneficiaries of Period-Certain Life Annuities. The proceeds from an annuity death benefit are taxable when they are received by the beneficiary. If you inherit an annuity youll have to pay income tax on the difference between the principal paid into the annuity and the value of the annuity when the owner dies.

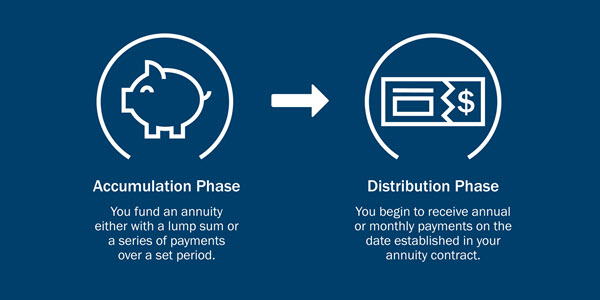

Your annuity income payments are classed as earned income and are subject to income tax just like the salary you will have received during your working life. For example if the. Once again withdrawals from annuities are taxed at the ordinary income tax rate not at the capital gains tax rate.

But this is not the case when inheriting an. Taxes and Annuity Payouts. Taxes at Death.

These payments are not tax-free however. Any growth or earnings inside of an annuity are tax-deferred until you start receiving income from the annuity. Im inheriting an annuity and Im being told that I will be responsible for taxes on 35000 of the annuity Tax Professional.

When an annuity owner dies the person or people identified as beneficiaries receive the annuity balance and must pay taxes on that amount. Benefits paid to a survivor under a joint and. How are non qualified annuities taxed to beneficiaries.

Some annuities are period-certain annuities which combine the benefits of a fixed annuity and life annuity by. In most cases non-qualified annuities can remain tax deferred all the way until the death of the owner. But taxation on contributions and.

This so-called inherited annuity is the. If the beneficiary selects a lump sum payment they must pay taxes. Depending on.

The beneficiary must figure the tax-free part of each payment using the method that applies as if he or she were the employee. Mark Taylor Certified Public Accountant CPA replied 16 hours. And you have the same amount.

The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. When you inherit an annuity you assume what is referred to as the owners basis which means you own the amount of already-taxed money in the account. If the surviving spouse is the beneficiary they can become.

The variable annuity contract may provide that at your death a person you name as a beneficiary will receive a lump-sum death benefit. For non-spouse beneficiaries of qualified annuities taxes depend on the payout structure that the beneficiary selects. When an individual inherits a life insurance policys death benefit they typically will not have to pay any income taxes.

For variable annuity contracts issued on or after 102979 and for all fixed annuity contracts there is no step-up in basis for income tax purposes and the beneficiary pays income tax on. The proceeds of inheritance are taxable.

Inherited Annuity Beneficiary Options

What Is The Best Thing To Do With An Inherited Annuity Due

Annuity Tax Consequences Taxes And Selling Annuity Settlements

How Are Inherited Annuities Taxed Annuity Com

What Is An Annuity Northwestern Mutual

Annuity Vs Mutual Funds Which Is Right For You 2022

The Annuity Advantage By Blue Horizon Insurance Financial Services Ppt Download

Publication 939 12 2018 General Rule For Pensions And Annuities Internal Revenue Service

:quality(70)/arc-anglerfish-arc2-prod-tronc.s3.amazonaws.com/public/OAFHAUVA2RAJFCZVIYH2CC7WV4.jpg)

Take Another Look At Beneficiary Designations Chicago Tribune

/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Life Insurance Vs Annuity What S The Difference

What Is A Fixed Annuity Nationwide

The Basic Principles Of Annuities Ameriprise Financial

Trust Vs Restricted Payout As Annuity Beneficiary

The Tax Treatment Of Annuities What You Need To Know

Do I Pay Taxes On All Of An Inherited Annuity Or Just The Gain

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

Inheriting An Annuity Inheriting Annuities Fully Explained Youtube